Optimize Your Finances: Discover Key Tax Strategies for Startups

Donec nec scelerisque leo. Nam massa dolor, imperdiet nec consequat a, congue id sem. Maecenas male suada faucibus finibus. Donec vitae libero porttitor, laoreet sapien a, ultrices leo…

Maximize Savings: Unlock the Benefits of Research Tax Credits

Donec nec scelerisque leo. Nam massa dolor, imperdiet nec consequat a, congue id sem. Maecenas male suada faucibus finibus. Donec vitae libero porttitor, laoreet sapien a, ultrices leo….

How to Successfully Request IRS Penalty Relief Easily Quickly

Donec nec scelerisque leo. Nam massa dolor, imperdiet nec consequat a, congue id sem. Maecenas male suada faucibus finibus. Donec vitae libero porttitor, laoreet sapien a, ultrices leo….

Foreign Trust Tax Consequences and Filing Requirements

Donec nec scelerisque leo. Nam massa dolor, imperdiet nec consequat a, congue id sem. Maecenas male suada faucibus finibus. Donec vitae libero porttitor, laoreet sapien a, ultrices leo….

How Budgeting Strengthens Core Bookkeeping Processes

Donec nec scelerisque leo. Nam massa dolor, imperdiet nec consequat a, congue id sem. Maecenas male suada faucibus finibus. Donec vitae libero porttitor, laoreet sapien a, ultrices leo….

Late Tax Return Filing Under Streamlined Filing Compliance Procedures

Donec nec scelerisque leo. Nam massa dolor, imperdiet nec consequat a, congue id sem. Maecenas male suada faucibus finibus. Donec vitae libero porttitor, laoreet sapien a, ultrices leo….

Essential Guide to Understanding US Expat Taxes and Compliance

Essential Guide to Understanding US Expat Taxes and Compliance Essential Guide to Understanding US Expat Taxes and Compliance Living abroad can be an exciting adventure, but it also comes with responsibilities, like paying taxes to the US. This guide will help you understand US expat taxes, so you can stay on the right side of […]

Tax Compliance for Non-US Amazon Sellers

Tax Compliance for Non-US Amazon Sellers Tax Compliance for Non-US Amazon Sellers Amazon FBA (Fulfillment by Amazon) offers a lucrative platform for international entrepreneurs to tap into the expansive US market. For non-resident sellers, establishing a US Limited Liability Company (LLC) can streamline operations and increase credibility. However, navigating the US tax system can be […]

Mastering Payroll Compliance: Essential Tips for Business Success

Mastering Payroll Compliance: Essential Tips for Business Success Mastering Payroll Compliance: Essential Tips for Business Success In today’s ever-evolving business landscape, payroll compliance is crucial for maintaining a company’s integrity and avoiding costly penalties. Navigating the complex web of federal, state, and local regulations can be daunting, but with the right strategies and tools, businesses […]

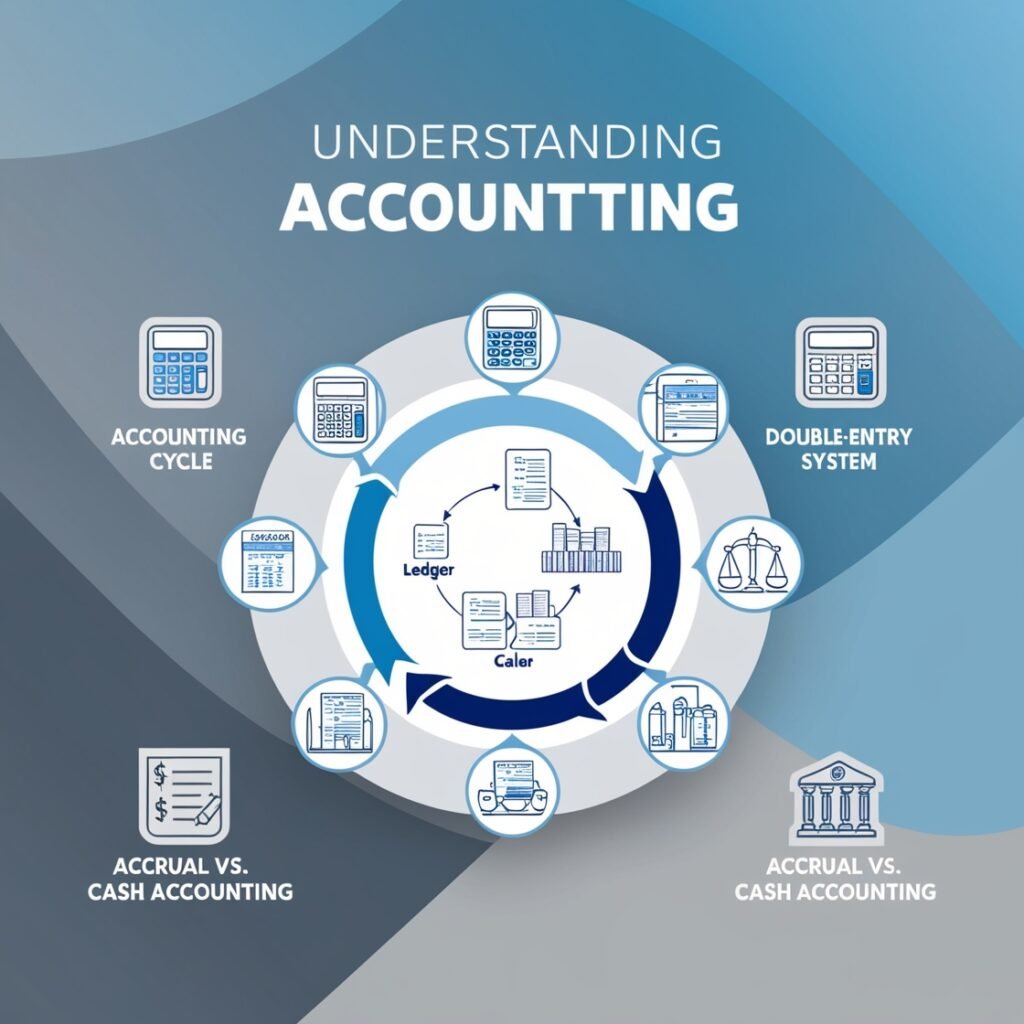

Accounting: Key Concepts and Benefits for Your Business

Accounting: Key Concepts and Benefits for Your Business Accounting: Key Concepts and Benefits for Your Business Accounting is the backbone of any successful business. It involves the systematic recording, analyzing, and reporting of financial transactions. For entrepreneurs and seasoned business owners alike, understanding the fundamentals of accounting can provide invaluable insights into your financial health […]