Accounting: Key Concepts and Benefits for Your Business

Accounting: Key Concepts and Benefits for Your Business

Accounting is the backbone of any successful business. It involves the systematic recording, analyzing, and reporting of financial transactions. For entrepreneurs and seasoned business owners alike, understanding the fundamentals of accounting can provide invaluable insights into your financial health and facilitate informed decision-making.

Key Concepts in Accounting

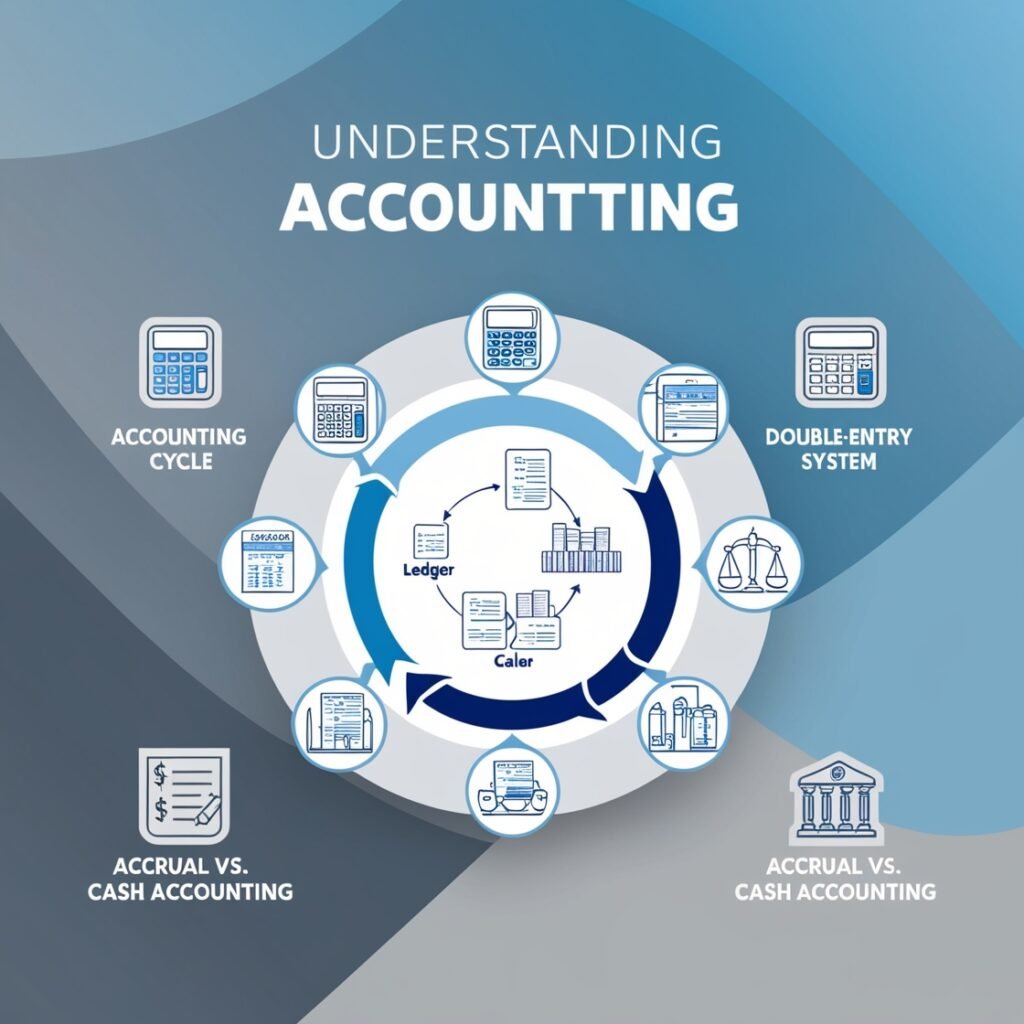

The Accounting Cycle

The accounting cycle is a series of steps taken throughout an accounting period to identify, record, and analyze financial data. The cycle includes:

- Identifying Transactions: Determining which economic events are relevant to the company.

- Recording Transactions: Logging these events into the accounting system.

- Posting to Ledger: Classifying and summarizing transactional data into relevant accounts.

- Preparing Financial Statements: Pulling together the data in structured reports such as the income statement, balance sheet, and cash flow statement.

- Closing Entries: Ensuring all temporary accounts are zeroed out, and the books are ready for the next accounting period

For businesses seeking assistance with the accounting cycle, our bookkeeping services at Eminent Tax can streamline these processes, ensuring accuracy and compliance.

Double-Entry System

This foundational principle ensures that every financial transaction affects at least two accounts, maintaining the accounting equation: Assets = Liabilities + Equity. This system helps ensure accuracy and helps identify errors quickly.

Learn more about how the double-entry system can benefit your business by scheduling a free consultation call with our accounting experts.

Financial Statements

Three primary financial statements provide a snapshot of your business’s financial health:

- Income Statement (Profit and Loss Statement): Shows the company’s revenues and expenses during a specific period, reflecting profitability.

- Balance Sheet: A summary of a company’s financial position at a point in time, outlining assets, liabilities, and ownership equity.

- Cash Flow Statement: Tracks the flow of cash in and out of the business, indicating the company’s liquidity and short-term viability.

Understanding these financial statements is crucial for any business. Explore our blog on accounting services ensure that these statements are accurately prepared and analyzed.

Accrual vs. Cash Accounting

Two primary methods of accounting dictate how transactions are recorded:

- Accrual Accounting: Records revenues and expenses when they are earned or incurred, regardless of when cash is exchanged. This method provides a more accurate picture of financial health.

- Cash Accounting: Records revenues and expenses only when cash is exchanged. It is simpler but can give a misleading view of long-term financial health.

Need help deciding between accrual and cash accounting for your business? Explore Forbes article

Benefits of Accounting for Your Business

Ensures Regulatory Compliance

Accurate accounting practices help ensure that your business adheres to local, state, and federal regulations. This includes tax filings, maintaining proper records, and compliance with financial reporting standards.

Our firm specializes in tax services that keep your business compliant with all regulations, minimizing the risk of penalties and fines.

Facilitates Better Decision-Making

Good accounting provides a clear financial picture, enabling business leaders to make informed decisions. It helps in understanding which parts of the business are profitable, where costs can be cut, and how financial resources can be better allocated.

Our comprehensive bookkeeping services provide the data you need to make informed business decisions.

Aids in Budgeting and Forecasting

Efficient accounting helps businesses create detailed budgets, allowing for more precise financial planning. With historical financial data at hand, forecasting future revenues and expenses becomes more accurate.

Explore our blog on Bookkeeping Tips for small businesses to enhance your financial planning process.

Improves Cash Flow Management

Proper accounting practices allow businesses to track cash inflows and outflows comprehensively. This ensures that you always have enough liquidity to meet your obligations, avoiding potential financial pitfalls.

Explore our blog on cash flow management to help you maintain optimal liquidity for your business operations.

Builds Trust with Stakeholders

Transparent and accurate financial reporting builds trust with stakeholders such as investors, banks, and suppliers. It shows that the business is well-managed and financially stable.

Learn more about how professional accounting services can enhance your credibility with stakeholders.

Supports Strategic Growth

Accounting provides insights into the financial performance and operational capacity of a business. These insights are critical for strategic planning, such as expansion opportunities, market penetration strategies, and competitive positioning.

Considering strategic growth? Our CFO services can help you align your financial strategies with your business goals.

Conclusion

Understanding the key concepts of accounting and leveraging its benefits can significantly impact the success of your business. By ensuring accurate record-keeping and financial reporting, you can make more informed decisions, ensure regulatory compliance, and foster business growth. Whether you manage your accounting in-house or outsource it to professionals, the importance of a robust accounting framework cannot be overstated.

Ready to enhance your accounting processes? Contact Eminent Tax today for a free consultation and learn how our tax and bookkeeping services can support your business growth.