eminent tax

Professional Bookkeeping

Bookkeeping You Can Trust.Accuracy You Can Count On.

Bookkeeping You Can Trust.

Accuracy You Can Count On.

Timely reports. Clean books. More time to focus on growing your business. Our CPA-supervised bookkeeping services give you the financial clarity you need to make confident decisions.

Streamlined Bookkeeping for Modern Businesses

Whether you need monthly bookkeeping services or a complete catch-up cleanup, our CPA-supervised team delivers accurate, timely financial reports that give you the insights you need to grow your business.

We specialize in QuickBooks Online setup, multi-state compliance, and industry-specific accounting needs. From transaction categorization to advanced financial reporting, we handle it all so you can focus on what you do best.

General Ledger

Reconciliations

AP/AR Management

Payroll Support

QBO Setup

Our Core Services

What's Included in Your Monthly Plan

Comprehensive bookkeeping services designed to keep your finances organized and compliant.

Categorization of Transactions

Proper coding and organization of all your business transactions

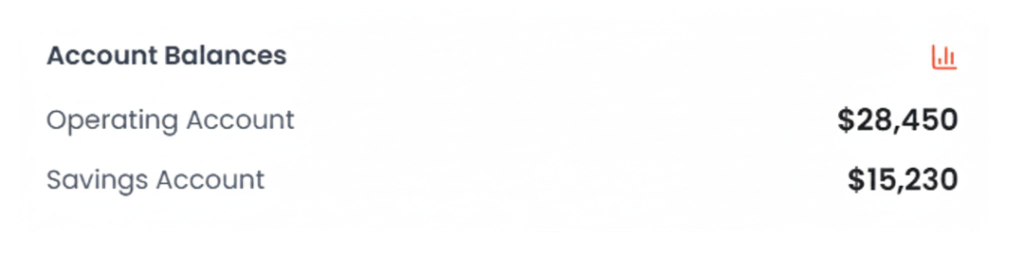

Monthly Reconciliations

Bank, credit card, PayPal, Stripe – all accounts reconciled monthly

Chart of Accounts Optimization

Customized chart of accounts tailored to your business needs

Financial Statements Delivery

Profit & Loss, Balance Sheet, and Cash Flow statements

Monthly Review with CPA Insights

Expert analysis and recommendations from our CPA team

Expense Tracking & Receipt Management

Paperless receipt management and expense categorization

Simple Pricing. Zero Surprises.

Choose between ongoing monthly service or catch-up cleanup.

Starter

$300

Perfect for new businesses

- < 50 transactions per month

- 1 bank account

- 1 credit card

- Monthly P&L and Balance Sheet

- Email support

- QuickBooks Online setup

Standard

$500

Most popular for growing businesses

- < 150 transactions per month

- Up to 3 accounts

- Monthly reporting

- Accounts payable/receivable

- Sales tax tracking

- Phone consultation

Advanced

$750+

For established businesses

- 150-500 transactions per month

- Unlimited accounts

- Dedicated CPA review

- Custom reporting

- Inventory tracking

- Priority support

How We Cleaned Up the Mess and Made It Easy

Real transformations from real clients who trusted us with their books.

E-commerce Brand

- Challenge:

8 months of messy books with multiple sales channels

- Our Solution:

Cleaned up books and integrated Shopify/QuickBooks automation

- Result:

Monthly financial clarity + automated sales tracking

Law Firm

- Challenge:

AP/AR chaos and IOLTA account compliance issues

- Our Solution:

Organized AP/AR processes and reconciled IOLTA accounts

- Result:

IRS-audit-ready books + compliant trust accounting

Tech Startup

- Challenge:

Cash-based books inadequate for investor reporting

- Our Solution:

Implemented accrual-based reporting and automated payroll

- Result:

VC investor-ready financials + streamlined operations

Why Choose Our Bookkeeping Services?

Professional credentials and proven results you can trust.

QuickBooks ProAdvisor Certified

5+ Years of US Business Bookkeeping

Payroll + Sales Tax Integration

CPA oversight with every report

Bank-level security & encryption

Dedicated account manager

Same-day response guarantee

Industry-specific expertise

“Finally, books I can understand! Vijay’s team turned our financial chaos into clear, actionable reports.”

SC

Sarah Chen

Chen Digital Marketing

Meet Your Bookkeeper

VM

Vijay Malani, CPA

Founder & Lead Bookkeeping Supervisor

- QuickBooks Certified ProAdvisor

- Gusto Payroll Certified

- IRS-Authorized Preparer

With over a decade of experience in bookkeeping and tax preparation, Vijay personally oversees every client’s books to ensure accuracy and compliance.

Our team combines technology with human expertise to deliver bookkeeping services that go beyond just recording transactions – we provide insights that help you make better business decisions.

- E-commerce

- Real Estate

- Professional Services

- Construction

Specializations:

Free PDF: 5 Bookkeeping Mistakes That Cost Businesses Thousands

Avoid costly errors and keep your books clean with our expert guide.

No spam, unsubscribe anytime. Join 800+ business owners getting our insights.

Ready for Reliable Books and Peace of Mind?

We’ll keep your finances in order so you can focus on growth. Get started with a free consultation today.

Free consultation • No obligation • Expert guidance guaranteed

Never Miss a Tax-Saving Opportunity Again

Join 2,500+ smart business owners who get exclusive tax strategies, deadline reminders, and money-saving insights delivered monthly.

Tax-Saving Strategies

Monthly insights that could save you thousands

Important Deadlines

Never miss a critical tax date again

New Deductions

Be first to know about new opportunities

IRS Updates

Stay compliant with regulation changes

- No spam, ever

- Unsubscribe anytime

- 100% privacy protected

- 2,500+ subscribers

- 4.9/5 rating

- Monthly delivery

-

2,500+

subscribers

- 4.9/5 rating

- Monthly delivery

Get Started Today

Join the exclusive community of tax-savvy entrepreneurs

First newsletter arrives in 24 hours with immediate tax-saving strategies you can implement this month.

- CPA Certified & IRS Enrolled

- Serving 20+ States

Our Services

Quick Links

Get In Touch

(555) 123-4567

Mon-Fri, 9AM-6PM PST

vijay@eminenttax.com

We respond within 24 hours

Remote Nationwide

Serving clients in 20+ states